2023 Outlook: The Offshore Service Vessel Market

The market for offshore support vessels has been through a rather rough few years since offshore exploration and production activity took a nose-dive in 2015 following the oil price crash the year before.The newbuild order boom that came with the ever-greener pastures imagined in the industry ensured that not only was the supply- and demand balance off by an insurmountable degree in the years that followed, but at its peak, in 2017, the oversupply of anchor handling tug supply- and platform supply vessels was in excess of 30% more units than the market required at its all-time high demand!And

Market Report: The Work Class ROV Market

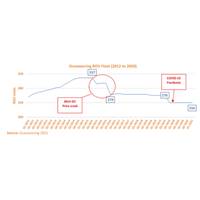

to medium-term. However, there’s a new kid on the block – offshore wind. Growth in this sector is seen as a key enabler for northern hemisphere countries (with access to a coastline and suitable wind conditions) to hit net zero.What does this mean for WROV demand? Following the 2014 oil price crash, many major ROV operators reduced their fleet size considerably. Oceaneering, which has the world’s largest fleet of WROVs, cut its fleet from 337 units in the third quarter of 2015, to 279 units by the end of the Q3 2016.Struggling to boost utilization, many ROV operators turned towards

An Overview of the Work Class ROV Market

to medium-term. However, there’s a new kid on the block – offshore wind. Growth in this sector is seen as a key enabler for northern hemisphere countries (with access to a coastline and suitable wind conditions) to hit net zero.What does this mean for WROV demand? Following the 2014 oil price crash, many major ROV operators reduced their fleet size considerably. Oceaneering, which has the world’s largest fleet of WROVs, cut its fleet from 337 units in the third quarter of 2015, to 279 units by the end of the Q3 2016.Struggling to boost utilization, many ROV operators turned towards

Offshore Drilling: It’s Going to Get Worse Before It Gets Better

led to a few contract cancellations and the first claims of force majeure.However, contract options are at most risk. Over $1.6 billion in contract value is at stake for options that are due to be exercised this year. Africa, Southeast Asia, and the Middle East make up over 50% of the total.With the oil price crash and COVID-19, the near-term outlook for the offshore rig market is on a lot of minds. RigLogix has contacted a number of rig owners and operators and the consensus seems to be that it’s going to get worse before it gets better, especially if current conditions persist. Announcements

TechnipFMC to Split into Two Companies

and gas projects. The split is expected to be final in the first half of 2020.The spin-off comes nearly three years after Technip merged with rival FMC Technologies, creating a leading London-based offshore services company with combined revenue of $20 billion. That deal closed near the nadir of an oil-price crash, when U.S. crude futures fell to about $26 a barrel and prompted cutbacks in spending on new offshore oil and gas development projects.Shares of TechnipFMC rose more than 6% before paring gains to 4.3% shortly before the close.Company names after the spin-off were not disclosed.Although the

TechnipFMC: Record Orders, Backlog in Q2

volume of orders in the second quarter, pushing its backlog of projects to a peak thanks to new liquefied natural gas projects, it said on Wednesday.The records could signal a rebound for the company created by a 2016 merger of France's Technip and U.S. rival FMC Technologies to weather the oil price crash that had forced their oil major clients to slash budgets and shelve projects."We achieved record inbound orders in the quarter, with total company orders reaching $11.2 billion," Doug Pferdehirt, chairman and CEO of TechnipFMC, said in a statement.Onshore/offshore inbound orders of

Aker Solutions Raises 2019 Forecasts

said.Rival Halliburton this month said that it expects global offshore spending to rise 14 percent in 2019, double the estimates given by sector leader Schlumberger NV.Aker still faces fierce competition as industry overcapacity looms after years of restraint by oil companies after the 2014-16 oil price crash, with pricing for subsea equipment still under pressure."We expect markets to remain competitive in certain segments. But we still see prices improving long-term," Araujo said.The subsea equipment industry has reduced capacity in some particularly labor-intensive segments during the

Singapore's Offshore Industry Recovering

will give (companies) enough money to reinvest in the future, which may happen probably next year," he said. "They are slowly increasing their investment but not in a big way. Demand is still pretty slow."Growth in Singapore's trade-reliant economy had slowed in the wake of the oil price crash. It has since recovered as output in sectors like electronics surged, though economists say the city-state faces growing headwinds from a bitter U.S.-China trade dispute.Dwindling ContributionThe offshore and marine engineering industry's direct output contribution has more than halved since

Schlumberger CFO Ayat to Retire Soon

frontrunner to replace Ayat, according to the people who declined to be named because the matter is not yet public.Schlumberger declined to comment.The CFO change would come as rising oil prices and dwindling producer reserves are helping lift demand for oil services, which were hit hard by the 2014 oil price crash.Schlumberger executives have said oil companies will have to increase spending to overcome declining output from existing fields and meet future demand.Ayat's successor will face pressure from investors concerned about past investments by the company's Schlumberger Production Management

February 2024

February 2024