Shearwater Bags Shell Black Sea Seismic Gig

Geophysical services company Shearwater GeoServices said that it has been awarded a Black Sea 3D seismic acquisition contract by the oil giant Royal Dutch Shell plc.The provider of 3D marine seismic data acquisition said in a press note that the survey would cover an area of approximately 600 square kilometers in the western Black Sea.The one-month project will commence in Q4 2019 and will be conducted by the Polar Empress.“We are very pleased to receive this award by Shell which will employ the Polar Empress in continuation of other successful work offshore Turkey this season” said Irene

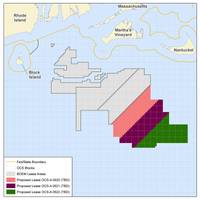

BOEM "Blown Away" by Record U.S. Offshore Wind Auction

A U.S. government auction for three wind leases off the coast of Massachusetts ended on Friday with record-setting bids totaling more than $400 million from European energy giants including Royal Dutch Shell Plc and Equinor ASA.The Bureau of Ocean Energy Management (BOEM) announced the sale's three winners - Equinor Wind US LLC, Mayflower Wind Energy LLC, and Vineyard Wind LLC, at the conclusion of the two-day sale that attracted 11 bidders and lasted 32 rounds.Mayflower is a joint venture owned by Shell and EDP Renewables, a division of Portugal's EDP. Vineyard Wind is a joint venture

Europeans Sweep Record US Offshore Wind Auction

A U.S. government auction for three wind leases off the coast of Massachusetts ended on Friday with record-setting bids totaling more than $400 million from European energy giants including Royal Dutch Shell Plc and Equinor ASA.The Bureau of Ocean Energy Management (BOEM) announced the sale's three winners - Equinor Wind US LLC, Mayflower Wind Energy LLC, and Vineyard Wind LLC, at the conclusion of the two-day sale that attracted 11 bidders and lasted 32 rounds.Mayflower is a joint venture owned by Shell and EDP Renewables, a division of Portugal's EDP. Vineyard Wind is a joint venture between

McDermott Wins Subsea Work from Shell

McDermott International, Inc. announced Tuesday it has been awarded a contract from Shell Exploration and Production Company, a subsidiary of Royal Dutch Shell plc, for new subsea umbilical and flowline installation at the Great White Frio development in Alaminos Canyon Block 857 in the U.S. Gulf of Mexico. The contract award will be reflected in McDermott's fourth quarter 2018 backlog.McDermott said its scope of work includes project management and engineering; installation of a flexible flowline from the well to a pipeline end termination; installation of one 2,000-foot-long steel flying lead;

Record-size US Offshore Oil Lease Sale Draws Modest Bidding

"I think we’re seeing continued consistent investment in the Gulf of Mexico," BOEM spokesman Mike Celata said in a conference call with reporters, adding he forecast increasing oil and gas production from the region for years. He said 33 companies, including majors Royal Dutch Shell Plc , BP Plc, Chevron Corp, and Total SA , had placed 159 bids on 148 blocks. But critics of the administration called the unusually large lease sale ill-timed. U.S. crude oil and natural gas output is already smashing records thanks to improved drilling technology that has opened up

As US Opens Up Offshore Waters, Eastern GoM Beckons

energy security - quicker than investing in other offshore areas." The American Petroleum Institute and the Independent Petroleum Association of America have also expressed an interest in the eastern Gulf on behalf of its members, and big driller Royal Dutch Shell Plc told Reuters in October that "we have appetite and we are interested" in the eastern Gulf. Trump's Interior Department has set up an "interagency working group" with the Defense Department to negotiate the issue, according to a Defense Department

Eni Begins Drilling Oil Well in Alaska's Beaufort Sea

island and at Oliktok Point, did not immediately reply to requests for comment. According to BSEE, Eni plans to use extended-reach drilling techniques to tap a formation on the Outer Continental Shelf that regulators approved a year ago. Eni is exploring the formation in partnership with Royal Dutch Shell Plc. The companies plan to drill two exploration wells plus two potential sidetrack wells over the next two years, according to BSEE. Shell in 2015 abandoned its exploration activities in offshore Alaska, citing high costs and stringent regulations. In April, U.S. President Donald Trump

Trump Administration Approves Eni Plan to Drill Offshore Alaska

, which were set to expire by the end of the year, were outside of an area protected by former President Barack Obama weeks before he left office. The company's plan to move ahead with risky and expensive drilling comes despite years of low oil prices and dangerous Arctic conditions. Royal Dutch Shell Plc quit its exploration quest offshore Alaska in 2015 after a ship it had leased suffered a gash in mostly uncharted waters and environmentalists had discovered an existing law that limited the company's ability to drill. Environmentalists complained that the administration rushed the

Mexico Auctions Two-thirds of Blocks in Shallow Water Oil Tender

itself and two in consortium with other companies. One comprised Capricorn and Mexican oil firm Citla, the other was with Citla alone. Citla also partnered with Capricorn to win another block. Russia's Lukoil also took a block in the auction, as did a tie-up between France's Total SA and Royal Dutch Shell Plc. The potential output from the shallow water oil and gas blocks auctioned could total 170,000 barrels per day of crude equivalent and investments could reach $8.2 billion, Energy Minister Pedro Joaquin Coldwell told a news conference. The auction was the latest step in Mexico's

February 2026

February 2026