Floating Solar Market Set to Surpass 6 GW by 2031, Says Wood Mackenzie

The global floating solar market is expected to pass the six-gigawatt (GW) threshold by 2031, as PV developers struggle to meet growing solar demand and look to alternate development technologies, energy intelligence firm Wood Mackenzie said in a report Wednesday.“The global solar industry, including PV developers, continue to battle limited land availability and increasing land costs for ground-mount solar projects, which is driving demand for floating installations,” said Ting Yu, consultant at Wood Mackenzie, at SNEC PV Power Expo in Shanghai Wednesday.According to Wood Mackenzie

CSignum Promotes Reyes to Chief Commercial Officer

CSignum the following year. Prior to CSignum, she promoted emerging technology research offerings to domestic and international energy and petroleum operators as a consultant at Darcy Partners and was Business Development Director at financial management consultancy, Conway MacKenzie. Reyes worked at Wood Mackenzie, a leading energy research and consultancy firm for ten years, working in consulting, offshore research and new product development roles focused on data analysis, economic models and global market trends. She began her career with six years at Shell Chemical Company, providing her foundation

Subsea Tiebacks: A Troll with a Kinder Surprise

is very profitable. Subsea technology is a part of the solution.”“Troll Phase 3 is a pretty unique project, and unlikely to be repeated. It’s also not a huge surprise if it rates as Equinor’s most profitable ever,” says Robert Morris, principal analyst, upstream, at Wood Mackenzie.“Using our Lens Upstream platform, we estimate the project will generate an IRR in excess of 60%, under our current pricing assumptions. That is the highest of any major upstream project to be sanctioned back in 2018. Costs and prices have obviously changed since then, but among all projects

Offshore Wind Could Bring In $1.7B to U.S. Treasury by 2022

The United States has an opportunity to accelerate offshore wind energy growth, and benefit from 28 new gigawatts of wind power and $1.7 billion in U.S. Treasury revenue by 2022, according to a study released by the energy intelligence group Wood Mackenzie. Apart from the benefits to the Treasury, the offshore wind industry in the U.S. could create 80,000 jobs annually from 2025 to 2035.Commissioned by four energy industry groups, American Wind Energy Association (AWEA), National Ocean Industries Association (NOIA), New York Offshore Wind Alliance (NYOWA), and the Special Initiative on Offshore

OneSubsea to Supply 20K SPS for Chevron's Anchor

project.The first phase will encompass a seven-well subsea development tied to a semisubmersible floating production unit (FPU) with planned design capacity of 75,000 barrels of crude oil and 28 million cubic feet of natural gas per day. First oil is expected in 2024.Justin Rostant, an analyst with Wood Mackenzie’s Gulf of Mexico team, expects that the Anchor FID will “kickstart the next wave of investments in US Gulf of Mexico.”“Anchor is the first of three 20,000 psi projects that Wood Mackenzie expects to reach FID within the next 18 months,” he said.“We estimate

Subsea Supply Chain Tightening -Proserv

oil companies (IOCs) to consult early with suppliers to prevent lead times lengthening.Proserv itself has seen increased orders for subsea tiebacks in recent months with contracts won from major oil companies in both the North Sea and the Gulf of Mexico, including from IOCs.Another consultancy Wood Mackenzie has estimated that the supply chain capacity for subsea equipment is 25 percent lower than it was before the oil price dip in 2014, while utilization has declined by around 40 percent in the intervening period.But the firm’s analysts nevertheless regard the subsea segment as more resilient

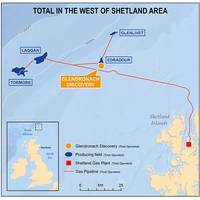

Total Makes Major Offshore UK Gas Discovery

the UK gas consumption."Glendronach is a significant discovery for Total which gives us access to additional gas resources in one of our core areas and validates our exploration strategy," Arnaud Breuillac, President of Total's Exploration & Production division, said in a statement.Wood Mackenzie North Sea research analyst Kevin Swann said it was the largest conventional discovery in the United Kingdom since Culzean in 2008, and it could contribute as much as 10 percent of the UK's annual gas production in its early years."Exploration in the UK has been a huge concern so far

Transocean to Buy Ocean Rig in $2.7 Bln Deal

drilling off Australia's southeast coast, while also pursuing finds at its offshore Guyana discovery."The announcement is not a surprise. Industry consolidation is necessary to get these premium assets back to work over the next two to three years," Leslie Cook, an analyst with Wood Mackenzie, said in a note.She added that, "as rates begin to float back up, the need to keep drilling costs down will drive demand for these newer rigs."Transocean will pay 1.6128 newly issued shares and $12.75 in cash for each share of Ocean Rig's common stock for an implied value of $32

Gulf of Mexico Lease Sale to Test Response to Trump-era Regulations

can begin. In February, the Interior Department's Royalty Policy Committee had recommended lowering the rates.Some companies may have bid on fewer parcels in March's auction, waiting to see if the Interior Department would cut royalties, said William Turner, a senior research analyst at Wood Mackenzie. In that auction, only 1 percent of the 77 million acres (31.2 million hectares) on offer received bids.Next week's sale is the first since U.S. Interior Secretary Ryan Zinke said in April that he would leave deepwater royalty rates unchanged at 18.75 percent, rather than drop them to the

February 2025

February 2025